What to know about prepaid travel credit cards

What to know about prepaid travel credit cards

Our editorial team and expert review board work together to provide informed, relevant content and an unbiased analysis of the products we feature. The editorial content on our site is independent of affiliate partnerships and represents our unique and impartial opinion. Learn more about our partners and how we make money.

Summary

Prepaid travel cards can make it easy to access cash while you’re traveling abroad, but remember that convenience comes with limitations.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs.

Finally ready to take your next international trip? Whether it’s a business meeting in Brussels or a foodie’s tour of Florence, you might consider packing a prepaid travel card for your trip.

Prepaid travel cards let you access cash in your destination’s local currency without the risk of using your debit card. They also let you avoid the high fees of credit card cash advances or the hassles of scrounging up traveler’s checks before you depart.

But, be careful – despite the convenience of prepaid travel cards, they come with their own set of fees and limitations (most notably ATM withdrawal and purchase amount caps that could put a damper on your vacation).

“A prepaid travel card is one tool in a diverse travel wallet,” said Julie Hall, internal communications manager for Hilton Grand Vacations and former public relations manager for AAA, in a previous interview. “It’s one of the most convenient ways to get money while traveling.”

Let’s take a look at everything you need to know about prepaid travel cards – from how they work to the pros and cons of using them for your travels.

How do prepaid travel cards work?

Prepaid travel cards work much like general-purpose prepaid cards, except that they typically offer special features and perks designed for travel – which can vary based on the issuing bank.

In general, to use a prepaid travel card, you purchase the card and simultaneously load it with the funds you want to spend on your trip, up to the maximum amount allowed on the card. (For example, the PayPal Prepaid Mastercard®, a general prepaid card, allows a maximum balance of $15,000.)

Once you’ve arrived at your destination, you can use your prepaid card to make purchases directly (much like you would with a debit card). You can also use it at an ATM to get cash in that destination’s currency.

Depending on the card issuer, you’ll be able to log in to a mobile app or your online account to check the balance, review your purchases and see any any account charges.

What are the benefits of a prepaid travel card?

Why not just take cash, your credit cards and your debit card the next time you travel to an international destination? Why would you also take a prepaid credit card?

If you lose your card, thieves only have access to the loaded cash

If a thief gains access to your prepaid card abroad, they’ll only have access to whatever funds are loaded onto the card (unlike debit cards, which can provide thieves access to your bank account, or credit cards, which a thief can charge up to a certain limit).

Further, the network through which a prepaid card is offered may provide a zero liability policy, though, overall, prepaid cards don’t offer the same breadth of protections as debit and credit cards (think chargebacks and fraud alerts).

Travel-friendly perks

Prepaid travel cards may offer some of the perks usually associated with rewards credit cards. For example, the Visa TravelMoney card from Inova Credit Union offers travel and emergency assistance, zero liability protection and emergency card and cash replacement. You can also set spending limits on this card to avoid busting your budget while traveling.

More convenient than traveler’s checks

Prepaid travel cards also provide more convenience than, say, traveler’s checks (which, yes, still exist). Getting traveler’s checks before you go can be a hassle, and you might also be surprised at how many retailers across the globe no longer accept them. As a result, prepaid cards are often a better option than these paper checks.

What are the drawbacks of a prepaid travel card?

Like most financial products, prepaid travel cards come with pros and cons. Here are some of the drawbacks of using one:

Foreign transaction fees, among others

Travelers should be wary of the fees connected to prepaid cards, as they can add up to a lot of money during an international trip. One of the more common (and costly) one associated with many prepaid cards is a foreign transaction fee. The AAA MemberPay Visa® Prepaid Card, for example, hits users with a foreign transaction fee of 3 percent for purchases made outside the United States. Today, it’s far easier to find credit cards with no foreign transaction fees than to find prepaid cards without them.

Further, prepaid travel cards may also charge a card purchase fee, ATM withdrawal fee, higher foreign ATM withdrawal fee, inactivity fee and a fee to get any remaining balance back by check.

No help for your credit score

If you charge restaurant meals, souvenirs and tickets to a traditional credit card and pay your bill on time, your three-digit credit score will receive a boost. This doesn’t happen with purchases you make with prepaid travel cards, because your prepaid card activity isn’t reported to the national credit bureaus.

If you don’t keep track, you could run out of funds

If you’re used to swiping a credit card without much thought, there’s a chance a prepaid card could leave you high and dry when you go to make a purchase. Just be sure to keep tabs on the amount of money you’ve loaded – and spent – on your card.

Prepaid travel card tips

Prepaid travel cards do come with some potential hurdles. Here are some tips for avoiding the most common downsides of these cards:

- Check the fees associated with your card (or potential card): Prepaid cards can charge fees that existing debit and credit card holders aren’t used to, so it’s important to read the fine print before swiping. For example, the Netspend® Visa® Prepaid Card charges a $5.95 inactivity fee per month after the card has been idle for 90 days.

- Verify the card will work at your destination: Double-check with your issuer that your prepaid card will be accepted where you’re traveling. Even a card that’s designed for international travel might not work in specific locations due to restrictions from U.S. trade sanctions.

- Know the limits: Prepaid travel cards typically have limits that could throw a wrench into your trip if you don’t understand them ahead of time. For example, some cards can have a daily reload limit as low as $500 (or as high as $7,500, in the case of the Netspend Visa card). Again: Make sure you read through your card’s fine print before embarking.

- Avoid holds at all costs: In a sense, prepaid travel cards work like debit cards. Be sure to avoid using a prepaid travel card to reserve a hotel room or a rental car, which can trigger a hold that could tie up hundreds of dollars of your cash for a week or longer. Instead, use a credit card to reserve these items, then use your prepaid card to pay the final charges.

Bottom line

A prepaid travel card doesn’t come without downsides, but if you want an easy way to access cash in your destination’s currency – and want a quick way to pay merchants once you arrive at your international destination – the ease of using them might make your trip a less stressful one.

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.

Allie Johnson is an award-winning freelance writer covering personal finance, business and lifestyle. She loves tracking down tips, tricks and cautionary tales about credit cards and money.

Dan Rafter has covered personal finance for more than 15 years for publications ranging from The Washington Post and Chicago Tribune to Wise Bread, HSH.com and MoneyRates.com. His work has also appeared online at the Motley Fool, Fox Business, Huffington Post, Christian Science Monitor and Time.

On this page

On this page

Essential reads,

delivered straight to your inbox

Stay up-to-date on the latest credit card news 一 from product reviews to credit advice 一 with our newsletter in your inbox twice a week.

Your credit cards journey is officially underway.

Keep an eye on your inbox—we’ll be sending over your first message soon.

Learn more about Education

10 common travel credit card mistakes you need to avoid

How to pay for holiday travel with plastic and avoid debt

Explore more categories

Questions or comments?

Editorial corrections policies

See the online credit card applications for details about the terms and conditions of an offer. Reasonable efforts are made to maintain accurate information. However, all credit card information is presented without warranty. When you click on the “Apply Now” button, you can review the credit card terms and conditions on the issuer’s web site.

Stay on top of industry trends and new offers with our weekly newsletter.

Your credit cards journey is officially underway.

Keep an eye on your inbox—we’ll be sending over your first message soon.

About

Contact

Related Sites

Copyright © 2022 CreditCards.com a Red Ventures Company. All Rights Reserved.

ADVERTISER DISCLOSURE CreditCards.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which CreditCards.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they appear within listing categories. Other factors, such as our proprietary website’s rules and the likelihood of applicants’ credit approval also impact how and where products appear on the site. CreditCards.com does not include the entire universe of available financial or credit offers.

CCDC has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

EDITORIAL DISCLOSURE All reviews are prepared by CreditCards.com staff. Opinions expressed therein are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including card rates and fees, presented in the review is accurate as of the date of the review. Check the data at the top of this page and the bank’s website for the most current information.

CreditCards.com credit ranges are derived from FICO® Score 8, which is one of many different types of credit scores. If you apply for a credit card, the lender may use a different credit score when considering your application for credit.

CreditCards.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which CreditCards.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants’ credit approval also impact how and where products appear on this site. CreditCards.com does not include the entire universe of available financial or credit offers.

CCDC has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Since 2004, CreditCards.com has worked to break down the barriers that stand between you and your perfect credit card. Our team is made up of diverse individuals with a wide range of expertise and complementary backgrounds. From industry experts to data analysts and, of course, credit card users, we’re well-positioned to give you the best advice and up-to-date information about the credit card universe.

Let’s face it — there’s a lot of jargon and high-level talk in the credit card industry. Our experts have learned the ins and outs of credit card applications and policies so you don’t have to. With tools like CardMatch™ and in-depth advice from our editors, we present you with digestible information so you can make informed financial decisions.

Our top goal is simple: We want to help you narrow down your search so you don’t have to stress about finding your next credit card. Every day, we strive to bring you peace-of-mind as you work toward your financial goals.

A dedicated team of CreditCards.com editors oversees the automated content production process — from ideation to publication. These editors thoroughly edit and fact-check the content, ensuring that the information is accurate, authoritative and helpful to our audience.

Editorial integrity is central to every article we publish. Accuracy, independence and authority remain as key principles of our editorial guidelines. For further information about automated content on CreditCards.com, email Lance Davis, VP of Content, at lance.davis@bankrate.com.

Are Balance Transfer Cards a Good Idea?

John Ulzheimer is an expert on credit reporting, credit scoring, and identity theft. The author of four books on the subject, Ulzheimer has been featured thousands of times in media outlets including the Wall Street Journal, NBC Nightly News, New York Times, CNBC, and countless others. With over 30 years of credit-related professional experience, including with both Equifax and FICO, Ulzheimer is the only recognized credit expert who actually comes from the credit industry. He has been an expert witness in over 600 credit-related lawsuits and has been qualified to testify in both federal and state courts on the topic of consumer credit. In his hometown of Atlanta, Ulzheimer is a frequent guest lecturer at the University of Georgia and Emory University’s School of Law.

Edited by: Lillian Guevara-Castro

Lillian brings more than 30 years of editing and journalism experience. She has written and edited for major news organizations, including The Atlanta Journal-Constitution and the New York Times, and she previously served as an adjunct instructor at the University of Florida. Today, she edits all CardRates content for clarity, accuracy, and reader engagement.

Balance transfer credit cards are often touted as a solution that could help you get a handle on your credit card debt. The question is, as it often is with credit products, is opening a new credit card to pay off another one actually a good idea? Isn’t that just using debt to pay off debt?

Everyone’s debt situation is different, of course. Yet, in many cases, a balance transfer credit card can be a very useful tool to help you save money on interest, pay down credit card debt, and perhaps even improve your credit score.

If you’re able to do all three of these highly desirable things by just opening and using a balance transfer card, then it’s certainly worth your consideration.

Balance Transfers Can Pay Off Big

A balance transfer is a credit card transaction where you move debt from one (or several) credit cards to a newly opened credit card account. You may be able to pay off other types of debt with a balance transfer as well, depending on the card issuer’s terms.

But for the purposes of our time today, we’ll focus on credit card debt because that is likely the most expensive debt you have.

Now, simply transferring debt from one credit card account to another credit card account may seem like a neutral transaction because you still have the same amount of debt. But, if you’ve got good enough credit, you may be able to qualify for a new credit card with a lower annual percentage rate (APR) than what you are currently paying on your existing cards.

Balance transfer credit cards often feature low interest rates or even 0% APRs for an extended period after you open the account and move your existing balances over. For example, you may find a balance transfer card that offers a 0% introductory APR for the first six to 18 months after account opening.

Zero percent is important because it means you’re essentially now borrowing money from your new credit card issuer for free.

The potential for these low (or no) introductory interest rates is what makes balance transfers an attractive option for people trying to get out of debt. When you can move high-interest debt to your new lower-rate balance transfer card, it could pay off in a big way.

Balance Transfers Credit Card Pros

If you’re not sure whether a balance transfer credit card is right for you, here are some benefits to consider:

- You will save money. Moving your debt to a credit card that has a lower interest rate than you’re paying now will save you money. The average credit card interest rate is 15.91% (for accounts that assessed interest, according to the Federal Reserve). And it’s not unusual to see credit card interest rates climb much higher than that, especially if they are retail store credit cards. If you can secure a 0% introductory APR and aggressively pay down your debt, the savings potential with a balance transfer card can be significant.

- You will get out of credit card debt faster. A lower introductory rate on a balance transfer card will help you pay down your debt faster. When you’re paying less interest per month, more of your payment goes toward your principal balance, even if you’re making the same monthly payment. If you can find ways to put extra money toward paying off your debt each month, a lower-rate balance transfer will mean you’ll get out of credit card debt faster.

- You will consolidate bills and payments. With a balance transfer, you will be able to move outstanding debt from several credit cards onto a new, single account. This action will consolidate the number of creditors you have to pay each month — making it easier to manage your budget. And to the extent you’re worried about missing payment, certainly making one payment on time is easier than making several payments on time.

- You may even improve your credit scores. As long as you don’t close your pre-existing credit card accounts, a new balance transfer card may help your credit scores. FICO and VantageScore credit scores have a metric called revolving utilization — or credit utilization ratio — which is essentially the relationship between your balances and credit limits. Adding a new credit card to your credit report should increase your aggregate credit limits and, in turn, lower your credit utilization ratios. And, if you reduce the number of credit cards with balances through consolidation, that too is a credit score improvement strategy.

It is important to point out that none of the above perks are automatic. But if you find and qualify for a good balance transfer deal, and you manage the balance transfer process wisely, you may be able to enjoy some or even all these benefits.

Balance Transfer Credit Card Cons

It’s nice to consider the perks that balance transfer cards have to offer. But you’ll want to take a moment to at least consider the potential drawbacks of balance transfer cards before you start filling out applications.

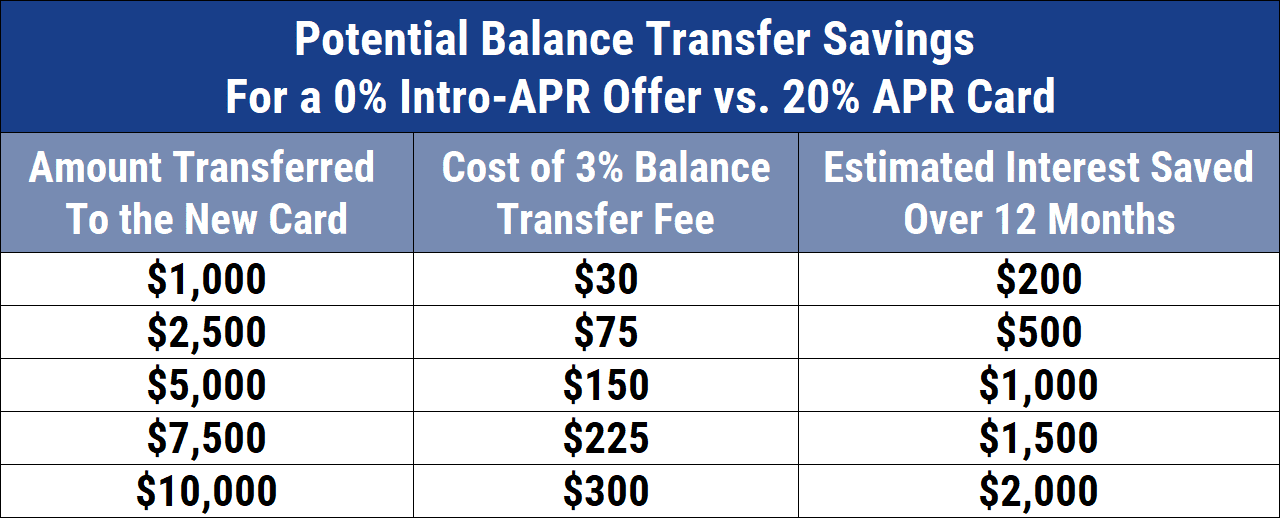

- Most credit card issuers charge a balance transfer fee when you move debt to your new card. Balance transfer fees typically run around 3% to 5% of the total amount you transfer. Let’s say you transfer $10,000 and the balance transfer fee is 5%. It will cost you $500 to move your debt to the new account in this scenario. It goes without saying that the cost of a balance transfer fee can offset your potential savings. So, you may want to use a balance transfer calculator to make sure the math adds up in your favor. HINT: If you save thousands of dollars of interest and it costs you $500 to do so, you win!

- Credit problems can disqualify you. Most balance transfer cards — especially those with the best offers — require you to have a good to excellent credit rating to qualify. If you’re struggling with a poor credit history or low credit scores, you may not be in a position to take advantage of a balance transfer offer.

- Retroactive interest. Read the language in your new card’s cardholder agreement and look for language regarding retroactive interest. If you do not pay off the transferred credit card debt before the expiration of the 0% interest period, you may have to pay interest on some or all of the original debt — all the way back to when you opened the new account. The point being, you may be on a clock that will incentivize you to get out of debt faster.

- You may have to change your habits. The best way to manage a credit card is to pay on time and pay off your full statement balance each month. It’s a bad idea to open a new balance transfer card, move all of your debts to it, and continue to overspend on your original accounts. Further, these actions can damage your credit scores and cost you any savings in interest fees.

For these reasons, you should only apply for a new balance transfer credit card if you’re confident that you can avoid overspending in the future.

How to Choose the Best Balance Transfer Credit Card

If you think a balance transfer card could help you pay down your credit card debt, it’s important to find the best account for you. Choosing the best credit card for you will involve some research on your part. Here are some tips to help you navigate that process.

Check Your Three Credit Reports

You should always review your three credit reports (and, ideally, your credit scores as well) before you apply for a new credit card. Checking your credit reports will give you an idea of your credit standing before the lender does the same thing. Then you can determine which cards you’re likely to qualify for based on your credit rating.

A credit check can also help you discover if you have any errors on your credit reports. If you do find mistakes, you should dispute them with the appropriate credit reporting agency. You can get your three credit reports for free every week through April 2022 at www.AnnualCreditReport.com.

Compare Balance Transfer Offers

As you’re reviewing available balance transfer card options, you should pay attention to four important factors — introductory APR, length of the promotional rate period, balance transfer fees, and annual fees.

The best deals will have the lowest APR (preferably 0%), the longest zero-interest promotional period, the lowest balance transfer fee, and no annual fee.

What are the Pros and Cons of Prepaid Credit Cards?

In the world of personal finance, there is seemingly no end to the various products, both credit and money related we can sign up for, then use at our leisure. However, our spending habits can easily get out of control, especially when it comes to credit cards. Being that credit cards are a form of revolving debt , where the credit limit resets every month, it can be tempting to simply pay the minimum monthly fees, all the while building up a hefty balance that we might not be able to afford down the line. Even some rewards cards, which can have a yearly fee over $100, are free to try for the first 12 months following the card’s activation. Another gimmick that can land a consumer in debt if they haven’t thought the decision through properly.

That’s where prepaid credit cards tend to make their appearance, or at least that’s just one of the reasons some consumers choose to purchase them over traditional credit cards. In fact, there are several rationalities that make prepaid credit cards both a justifiable and not-so-justifiable choice, and we’ll explain some of them in the article below.

What is a Prepaid Credit Card?

Before weighing the benefits and drawbacks of using prepaid credit cards, we must first learn what they are. Unlike a traditional credit card, which will have a monthly credit limit, a prepaid credit card has a total cash limit. Instead of that limit resetting itself at the beginning of every month, a prepaid credit card already has a specific amount of money on it. If you should spend any of that money, the limit will drop in accordance with how much you’ve spent. The limit that a prepaid card can hold is typically dependant on the policies of the company that issues it, but it can range anywhere from a few hundred dollars, all the way up to $15,000 in some cases.

Prepaid cards are usually purchased through the same companies that deal in normal credit cards, such as MasterCard or Visa, although you can sometimes get them as promotional products through partnering companies and retailers. However, since they don’t actually involve credit, they’re really only called “credit cards” because they’re mostly sold by credit card companies.

For 10 more questions to ask about prepaid credit cards, click here .

How to Use a Prepaid Credit Card

Anyone who wants a prepaid credit card need only purchase one through the credit card company of their choice, which you can do at your bank, on the internet, or over the phone. Where prepaid cards differ from regular credit cards is that they usually require no credit check or application. You simply need to be 18 years of age or older, unless your parents give their bank permission to open you an account, which is common. Parents will often open a prepaid account for their children as a gift, or to introduce them to the idea of using credit, all while keeping their spending under control.

A prepaid card functions much like a gift card that you would purchase from any retailer, but that you can use in multiple types of locations. You pay a small fee for the card itself, then you can fill it up as needed, to whatever limit you would like it set to. Prepaid cards resemble that of a typical chequing account, more than they do an actual credit card. If you decide to put $500 on the card, then buy something that costs $200, you’ll have $300 remaining until you decide to fill the card up again. Like a regular credit card, you can pay for things using an electronic terminal at retailers, restaurants, gas stations, or anywhere else prepaid cards are accepted. You can also use it for purchasing things online and over the phone.

Prepaid credits don’t affect your credit score. Watch the video above to find out what does.

What is the Difference Between a Prepaid Credit Card and a Regular Credit Card?

Even though prepaid credit cards are mostly sold by companies that are better known for their regular credit cards, the two types of cards are actually different in many ways. While at first glance, prepaid cards might look exactly the same, they way they function is altogether different.

- With a regular, unsecured credit card, you’re borrowing money from your bank or other financial institution, who will have a partnership with a certain credit card company. A prepaid card contains your money only.

- With your regular credit card, you’ll have a balance to pay each month. If you should fail to pay that balance, you’ll be charged a penalty. However, there will be a minimum payment that you can make to avoid said penalty. Once you’ve paid your full balance, your credit limit resets. The only limit a prepaid card has is how much money you’ve put on it.

- Many credit cards, both regular and secured, come with some degree of interest, while prepaid cards do not.

- Any activity on your regular credit cards will appear on your credit report and affect your credit score in various ways. Responsible usage (paying your bills on time and in full, not going over your credit limit, etc.) will strengthen your credit, and any irresponsible usage (late/short payments, etc.) will damage it. Prepaid cards have no effect on your overall credit because they are not credit at all.

- If your regular credit card gets stolen, it’s easier to cancel it, possibly even get some of your money back if the thief has spent it. With prepaid cards, on the other hand, it will be much harder to get your money back, because it’s already on the card and taken directly from your bank account.

- All credit cards, whether they are secured or not, have an expiry date (usually 1-5 years). When the card expires, a new, free card will arrive by mail. You just need to call the credit card company afterward to reactivate it, which will also probably be free. Many prepaid cards also expire, as is the case with promotional prepaid cards during award programs, however, the funds on them do not. But here, you have to purchase a whole new card, then pay again to have the credit card company transfer the remaining funds to it.

Check out our other article for more information on Consumer Debt .

What is the Difference Between a Prepaid Credit Card and a Secured Credit Card?

Secured credit cards are actually more similar to prepaid cards than regular credit cards are. For instance, both secured credit and prepaid cards are often advertised to those with poor credit. Both types of cards also require you to put money on them upfront. With a prepaid card, you must pay for the card itself, then put money on it before you can use it. Secured credit cards require a deposit before they’re activated.

Then again, secured credit cards are also different in certain ways:

- Yes, secured cards are called “secured” because they require a security deposit before they’re approved. However, that deposit will be put in a separate savings account or a certificate of deposit. So, if the consumer should default on their payments, their deposit is forfeit. If they keep up a streak of responsible credit usage, the credit card company can switch them over to an unsecured credit card, and their security deposit will be refunded. When you pay for a prepaid card, then spend the money you’ve put on it, your money is gone.

- Like a regular credit card, you’ll have a specific revolving credit limit that goes up and down as you make charges and pay your bills. You’ll also need to keep up with monthly payments, be charged interest, and incur penalty fees if and when you miss payments. None of this applies to prepaid cards.

- Responsible and irresponsible use will also have an effect on your overall credit. Prepaid cards, no matter how you use them, do not affect your credit.

- Some secured cards, like regular credit cards, have annual fees. Prepaid cards do have fees, but for different reasons (read the sections below for more information).

- You’ll be offered the same services as a regular credit card, such as balance protection in the event of unemployment, disability, etc. Since a prepaid card already contains your money, there’s no need to offer this.

Read this for more information on the differences between prepaid cards and secured cards.

The Advantages of a Prepaid Credit Card

Prepaid credit cards come with many qualities that make them attractive to some consumers. For example:

- You do not need to have good credit to purchase a prepaid credit card. If your credit is poor, or you don’t qualify for a regular credit card for whatever reason, you should still be able to purchase a prepaid card. There is usually no credit check performed when considering you as a client.

- You also don’t need to apply for a prepaid card, as you would with a typical credit card.

- Prepaid cards can be given out as gifts that anyone can use. Parents commonly give them to their children for this reason.

- They have a specific limit that can be refilled at any time. This is a good way of making sure that the cardholder doesn’t go overboard on their spending.

- You won’t have to deal with late penalties, interest charges, or monthly bills.

The Disadvantages of Prepaid Credit Cards

While they have many noteworthy qualities, prepaid credit cards, like any type of financial product, do come with their disadvantages, such as:

- Prepaid credit cards usually come with a number of fees specific to the brand of card it happens to be. These fees can include but aren’t limited to: a purchase and activation/reactivation fee, an ATM withdrawal fee (in addition to what the machine charges), a replacement fee (if the card is lost or stolen), a reloading fee, etc.

- While you can use a regular/secured credit card almost anywhere, many locations do not accept prepaid cards.

- Some prepaid cards cannot be used outside the country where they were activated. So, if you bought the card in Canada, you might not be able to use it in the United States. Make sure to check the cardholder agreement for policies like: “Valid in Canada only.”

- If you spend everything on the card, you won’t be able to use it again until you refill it. No revolving credit might mean no money during an emergency.

- Lost or stolen cards are hard to redeem. Not only will you have to pay for a new card, the funds already on them might not be salvageable.

- You need to keep the card number written down somewhere, just in case. With a regular credit card, the card issuer is able to either give you a new card with the same number, or a new one (if the card was stolen). If you don’t have your prepaid card’s number, and it gets lost or stolen, anything you have left on it will be gone for good.

- Unlike regular/secured credit cards, prepaid cards will not rebuild or affect your credit in any way. Since the card is based on money, rather than credit, the card company will not report any activity to Canada’s credit reporting agencies (Equifax and TransUnion), so any responsible usage will not improve your credit score.

What Type of Consumer Should Use a Prepaid Credit Card?

As we mentioned earlier, there are a few kinds of consumers that can benefit more from the use of a prepaid credit card than they would a regular or secured credit card. Since they aren’t really considered credit cards (just debit-style cards issued by credit card companies) consumers with poor credit are one of the key groups that they’re advertised towards. So, if you happen to have a low credit score and are having trouble getting approved for a normal credit card, prepaid cards might be the right choice for you.

Prepaid cards can also be a good gift for a family member or loved one. The receiver can spend the money on whatever they want and any extra fees will be taken out of the card’s holdings. Once the card is empty, they can simply have it deactivated, then throw it away, or refill it themselves. They are also common among students, who need to pay for books and other supplies, all while sticking to a set limit.

However, if you’re looking to build or improve your credit, a prepaid credit card is not the best choice. In this case, if you already have favorable credit, a regular credit card will benefit you more. If you have poor credit, using a secured credit card until you can have it converted to an unsecured one will likely be the best option.

Always Do Research, then Read the Fine Print!

If you’re thinking about buying a prepaid card instead of a typical credit card, just make sure you’re being cautious about it and taking all factors into consideration beforehand. Do some research before making any decisions, this will help you make sure that both the card company and the card itself are legitimate.

For some important information on prepaid credit card scams, click here .

If and when you’ve found a prepaid credit card that you think is a good fit for your financial situation, make sure you know everything about the product that you’re about to buy. Tedious as it may be, just like you should with any financial product, carefully read the fine print in the cardholder clause, this way you’ll be completely informed about any fees and rules that come with the card. If you’re happy with the prepaid card, you can continue to spend wisely until you’re ready for the responsibility of a regular credit card.

Source https://www.creditcards.com/education/prepaid-travel-cards-pros-cons/

Source https://www.cardrates.com/advice/are-balance-transfer-cards-a-good-idea/

Source https://loanscanada.ca/credit/what-are-the-pros-and-cons-of-prepaid-credit-cards/