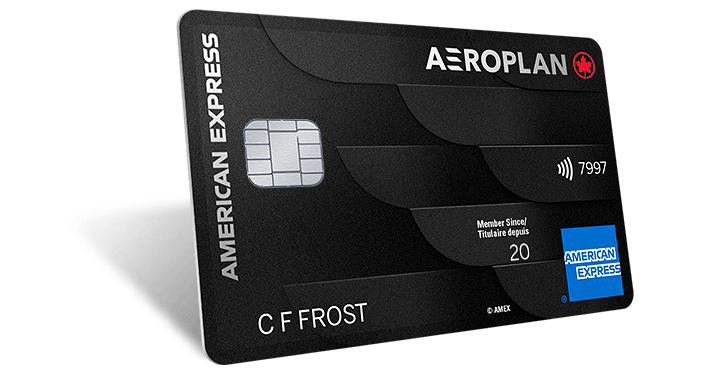

American Express®

Aeroplan ® * Reserve Card

Through our partnership with Aeroplan, you have access to a variety of great Air Canada®* travel and airport benefits that can make your journey even more enjoyable. And with the points you earn on your Card, you’ll have the opportunity to redeem for a variety of options.

KEY BENEFITS

Earn & Redeem Aeroplan Points

Use your Card to earn Aeroplan points on eligible purchases made directly with Air Canada ® * & Air Canada Vacations ® *, dining and food delivery purchases in Canada, and on everything else. 1 And your points can go a long way with extensive redemption options available from Aeroplan such as flight rewards, hotel and car rentals, cabin upgrades, and more.

American Express ® Experiences

Never miss out on a must-see event again with Front Of The Line ® . Get presale and reserved tickets 2 to virtual buzzworthy concerts, shows, drive-in events, and more!

Air Canada Travel Benefits

Make your travel experience one to remember with travel benefits such as Maple Leaf Lounge TM access 3‡ , a free first checked bag (up to 23kg/50lb) 4‡ , Priority Airport Services 5‡ and more. There’s so much waiting for you to experience.

Your new American Express Aeroplan Reserve Card is made from precision cut and engraved 13 g metal — it’s the perfect companion on your next exceptional journey.

Terms and Conditions

‡ Please ensure that you provide your personal Aeroplan number to be linked to your card account as linking a different loyalty number may impact the airline benefit fulfillment.

The Aeroplan number of the person accessing the benefit must be included in the qualifying reservation, and the name on the airline reservation must be identical to the name on the Aeroplan account of the traveler. For eligible Supplementary Cardmember(s) ability to access available benefits, their Aeroplan number must be linked to a valid credit card account as verified by the bank. Linking can be done by visiting www.aircanada.com/linkmycard. Please allow up to 72 hours after the credit card is approved, or the Aeroplan number of the eligible Supplementary Cardmember is linked to the Additional Supplementary card, for these benefits to be activated. Aeroplan member accounts of the Basic Cardmember and eligible Supplementary Cardmember(s) must be in good standing at time of flight for airline benefits to apply. Airline benefits will no longer be available upon account closure, regardless of reason for closure, or if the card product is changed. Aeroplan membership and benefits are subject to the Aeroplan Program Terms & Conditions and any applicable Air Canada terms and conditions relating to a benefit, as determined by Air Canada in its sole discretion and as may be changed from time to time.

1 You can earn Aeroplan points (“points”) for eligible consumer purchases at American Express retail merchants as follows: Earn 3 points for every $1 of eligible purchases made directly with Air Canada. Earn 2 points for every $1 at restaurant, quick service restaurant, coffee shop, and drinking establishments in Canada, and delivery of food in Canada as a primary business, but not including groceries. Eligible Air Canada purchases means only those purchases made directly with Air Canada as the merchant, including Air Canada Vacations packages purchased directly from Air Canada. Air Canada purchases using your card at another merchant or service provider that sells Air Canada goods or services would not be an eligible Air Canada purchase, such as purchasing (i) Air Canada tickets from an online website other than Air Canada, through a travel agent including American Express Travel Services, or as part of a vacation package from another merchant, (ii) Air Canada gift cards, (iii) Air Canada Maple Leaf Club memberships or (iv) if you make a purchase through Air Canada with another merchant such as a hotel or car rental booking on the aircanada.com website. Earn rate of 1.25 points for every $1 applies when the merchant code is not in an eligible category, using a payment account or service of a third party, a card reader attached to a mobile phone or online retailer that sells goods of other merchants or the merchant category is otherwise not identified. Provided your account is in good standing, points can be earned on eligible purchases less returns and other credits. Interest charges, annual fees, other fees and cash equivalent transactions are not purchases and do not qualify for Aeroplan points.

2 Purchase must be charged in full to an American Express Card. Subject to availability and to event and ticketing terms, restrictions, verification procedures and fees. Tickets and packages may not be transferable and should not be resold. No refunds and no exchanges subject to merchant’s obligations under applicable law.

3 A Basic Cardmember and eligible Supplementary Cardmember(s) are each entitled to complimentary access to Air Canada Café and any Maple Leaf Lounge located only in Canada and the United States, including International Maple Leaf Lounges in Canada and the United States when travelling on an international itinerary. Access excludes Maple Leaf Lounges outside of Canada and the United States, Air Canada Signature Suites, and lounges operated by third parties, such as Star Alliance member airlines. Basic and eligible Supplementary Cardmember(s) are each entitled to offer one (1) guest complimentary access to the same eligible Maple Leaf Lounge and Air Canada Café. Any guest entering a Maple Leaf Lounge and Air Canada Café must be accompanied by a Basic or eligible Supplementary Cardmember. Additional guest(s) may enter the Maple Leaf Lounge upon paying an applicable fee. For greater certainty, a Basic Cardmember or eligible Supplementary Cardmember who holds Aeroplan Elite Status, may additionally take advantage of the lounge access benefits available to them as part of the Aeroplan Elite Status program. For more information on Aeroplan Elite TM Status, please visit aircanada.com/elitebenefits. Access to Maple Leaf Lounges and Air Canada Café is available in conjunction with a same-day ticket when departing on a flight marketed or operated by Air Canada, Air Canada Rouge, under the Air Canada Express brand, or any Star Alliance member airline. Anyone under the age of majority entering a Maple Leaf Lounge must be accompanied by an adult with access to the lounge. Age of majority is determined by the jurisdiction in which the Maple Leaf Lounge is located. Benefit may only be used as described, and otherwise cannot be transferred. Access is subject to space availability. See www.aircanada.com/lounges-termsandconditions for applicable Maple Leaf Lounges Terms and Conditions.

4 A Basic Cardmember or eligible Supplementary Cardmember, and up to eight (8) other passengers traveling on the same reservation (up to a maximum of 9 travellers), are each entitled to a free first checked bag up to 23kg/50lb. Benefit only applies when checking in with Air Canada, for a flight operated by Air Canada, Air Canada Rouge or under the Air Canada Express brand. Benefit is not available if check-in is with another airline. If the first checked bag is already complimentary (for example, as a result of Aeroplan Elite TM Status or fare purchased), there is no additional checked bag benefit that will be provided. Free first checked bag benefit may not be applied retroactively, and no refunds will be issued. Service charges for additional/oversized/overweight baggage may apply. For more information on baggage restrictions, please visit www.aircanada.com/baggage.

5 A Basic Cardmember or Supplementary Cardmember, and up to eight (8) other passengers traveling on the same reservation (up to a maximum of nine (9) travellers), are each entitled to Priority Check-in (where available), Zone 2 Priority Boarding and Priority Baggage Handling. Benefits only apply when checking in with Air Canada, for a flight operated by Air Canada, Air Canada Rouge or under the Air Canada Express brand. Benefit is not available if check-in is with another airline. To access this benefit, the Basic Cardmember or Supplementary Cardmember may be required to show their qualifying card to the Air Canada agent.

® : Used by Amex Bank of Canada under license from American Express.

Earn Aeroplan points now to use

for the experiences that await you

Earn 3x Aeroplan points

Earn 3 Aeroplan points for every $1 spent on eligible purchases made directly with Air Canada ® * and Air Canada Vacations ® * .1

Earn 2x Aeroplan points

Earn 2 Aeroplan points for every $1 spent on eligible dining and food delivery purchases in Canada. 1

Earn 1.25x Aeroplan points

Earn 1.25 Aeroplan points for every $1 spent on everything else. 1

You can also present your Aeroplan Card at over 150 Aeroplan partner brands and at 170 online retailers via the Aeroplan eStore and pay with your American Express Aeroplan Card to earn points twice!

Use Aeroplan points to get more out of every moment

Use points with Aeroplan to:

- Book Air Canada flights and vacations

- Redeem for cabin bid upgrades and in-flight Wi-Fi

- Pay for hotels and car rentals

- Redeem for merchandise, gift cards and experiences

Terms and Conditions

1 You can earn Aeroplan points (“points”) for eligible consumer purchases at American Express retail merchants as follows: Earn 3 points for every $1 of eligible purchases made directly with Air Canada. Earn 2 points for every $1 at restaurant, quick service restaurant, coffee shop, and drinking establishments in Canada, and delivery of food in Canada as a primary business, but not including groceries. Eligible Air Canada purchases means only those purchases made directly with Air Canada as the merchant, including Air Canada Vacations packages purchased directly from Air Canada. Air Canada purchases using your card at another merchant or service provider that sells Air Canada goods or services would not be an eligible Air Canada purchase, such as purchasing (i) Air Canada tickets from an online website other than Air Canada, through a travel agent including American Express Travel Services, or as part of a vacation package from another merchant, (ii) Air Canada gift cards, (iii) Air Canada Maple Leaf Club memberships or (iv) if you make a purchase through Air Canada with another merchant such as a hotel or car rental booking on the aircanada.com website. Earn rate of 1.25 points for every $1 applies when the merchant code is not in an eligible category, using a payment account or service of a third party, a card reader attached to a mobile phone or online retailer that sells goods of other merchants or the merchant category is otherwise not identified. Provided your account is in good standing, points can be earned on eligible purchases less returns and other credits. Interest charges, annual fees, other fees and cash equivalent transactions are not purchases and do not qualify for Aeroplan points.

® : Used by Amex Bank of Canada under license from American Express.

From experiences to offers

American Express has your back

Enjoy exclusive benefits only with American Express at Toronto Pearson International Airport

- Access to Pearson Priority Security Lane 1

- Complimentary valet service 2

- 15% discount on parking rates at the Express Park and Daily Park 3

- 15% discount on Car Care Services 4

$100 NEXUS ◊ Card Statement Credit

Stay focused on getting where you need to go. Receive up to $100 CAD in statement credits every four years when a NEXUS application or renewal fee is charged to your American Express Aeroplan Reserve Card. 5

Airport lounge access worldwide

Your American Express ® Aeroplan ® * Reserve Card gives you access to more than 1,200 airport lounges around the globe. That means an oasis of comfort before your flight — regardless of your choice of airline or cabin class.

Unwind with complimentary light refreshments and drinks or take advantage of the many business amenities. The $99 USD annual Priority Pass TM6 membership fee is waived for Cardmembers and each lounge visit is subject to a usage fee at the prevailing rate. 6

To enrol for your complimentary Priority Pass membership, please call American Express at 1-800-263-1616.

See it. Hear it. Feel it. First.

With American Express ® Experiences – available only to American Express Cardmembers – you can enjoy special access to some of your favourite events in entertainment, dining, retail and more. 7

Throughout the year, you’ll receive access to curated events like unique dining experiences, exclusive virtual parties, special online shopping and more – created just for American Express ® Aeroplan ® * Reserve Cardmembers.

Enjoy more rewards with Amex Offers

Enjoy offers that are tailored to all of your favourite things like dining, shopping, travel and more. New offers are always being added, so be sure to check regularly through the Amex App or Online Services. 8

Coverage you can feel confident about

TRAVEL COVERAGE

Out of Province/Country Emergency Medical Insurance 9†

Can provide coverage of up to a maximum of $5,000,000 for eligible emergency medical expenses incurred by an insured person under age 65 while travelling outside your Canadian province or territory of residence for the first 15 consecutive days of a covered trip.

Car Rental Theft and Damage Insurance 10†

You can be covered for theft, loss and damage of your rental car with an MSRP of up to $85,000 for rentals of 48 days or less when you fully charge your rental to your American Express Aeroplan Reserve Card. To take advantage of this protection, simply decline the Collision Damage Waiver (CDW), Loss Damage Waiver (LDW) or similar option offered by the car rental agency.

Lost or Stolen Baggage Insurance 9†

You can be covered for loss or damage to your checked-in or carry-on baggage and personal effects while in transit for up to a maximum of $1,000 per trip for all insured person(s) combined when you fully charge your airline tickets to your American Express Aeroplan Reserve Card.

Hotel Burglary Insurance 9†

You can receive up to $1,000 in coverage against the loss of most personal items (excluding cash) if your accommodation is burglarized when you fully charge your accommodations to your American Express Aeroplan Reserve Card.

Flight Delay Insurance 9†

You can receive up to $1,000 in coverage (aggregate maximum with Baggage Delay Insurance) for necessary and reasonable accommodations, restaurant expenses and sundry items purchased within 48 hours when delayed or denied boarding for 4 hours or more and no alternate transportation is made available when you fully charge your airline ticket to your American Express Aeroplan Reserve Card.

Baggage Delay Insurance 9†

You can receive up to $1,000 in coverage (aggregate maximum with Flight Delay Insurance), for reasonable and necessary emergency purchases for essential clothing and sundry items purchased within four days of arrival at your destination when your checked-in baggage on your outbound trip is delayed for 6 or more hours when you fully charge your airline ticket to your American Express Aeroplan Reserve Card.

$500,000 Travel Accidental Insurance 11†

You can be covered up to $500,000 of Accidental Death and Dismemberment Insurance when you fully charge your common carrier (plane, train, ship or bus) tickets to your American Express Aeroplan Reserve Card.

Trip Interruption 9†

When you charge your travel arrangements to your American Express Aeroplan Reserve Card this insurance can cover the non-refundable and non-transferable unused portion of your travel arrangements purchased before your departure date, should your trip be interrupted or delayed for a covered reason. You can be covered for up to $1,500 per insured person, per trip, up to a maximum of $6,000 for all insured persons combined.

Trip Cancellation 9†

You can be reimbursed for the non-refundable and non-transferable portion of your travel arrangements when charged to your American Express Aeroplan Reserve Card before your departure date should you cancel your trip for a covered reason. You can be covered for up to $1,500 per insured person, per trip, up to a maximum of $3,000 for all insured persons combined.

RETAIL COVERAGE

Buyer’s Assurance ® Protection Plan 12†

Your coverage can automatically extend the manufacturer’s original warranty up to one additional year when you fully charge eligible items to your American Express Aeroplan Reserve Card.

Purchase Protection ® Plan 9†

You can be insured for eligible items charged to your American Express Aeroplan Reserve Card for 90 days from the date of purchase in the event of accidental physical damage or theft for up to $1,000 per occurrence (for all purchased items combined).

To learn more about the insurance coverage included on your American Express Card, or to make a claim click below.

† All insurance coverage is subject to the terms and conditions of their respective master policies. Certain limitations, exclusions and restrictions apply.

Terms and Conditions

1 American Express Basic and Supplementary Cardmembers with an eligible Card are entitled to access the Pearson Priority Lanes (“Priority Lanes”). The Priority Lanes are serviced by the Greater Toronto Airport Authority. Priority Lanes are located at select departure areas at Toronto’s Pearson International Airport in Terminals 1 & 3. Access to a Pearson Priority Lane is available to eligible Canadian Cardmembers and companions travelling on the same itinerary. The eligible Cardmember can request single-use QR Codes online by visiting go.amex/yyz. For assistance, please call the phone number on the back of your card. Access to the Priority Lanes is intended for the Basic and Supplementary Cardmember and a reasonable number of persons travelling with them on the same itinerary. If we determine, in our sole discretion, that a Cardmember (or Supplementary Cardmember, as applicable) is not using this benefit as intended, we reserve the right to revoke your access to the benefit or to cancel your Card account. All passengers departing from Pearson International Airport, including those accessing the Priority Lane, are required to comply with airport security and customs screening requirements. Priority Lanes access is subject to change or cancellation at any time and additional terms and conditions apply.

2 Toronto Pearson Valet Service – Basic and eligible Supplementary American Express Aeroplan Reserve Card members must charge the parking fee to their American Express Aeroplan Reserve Card for the associated Valet fee to be waived. The American Express Aeroplan Reserve No Fee Supplementary Cards are not eligible for this benefit. Waived fee applies only to Toronto Pearson Airport Valet Services in Terminal 1. For more information on Valet Service visit torontopearson.com.

3 Toronto Pearson 15% Parking Discount – Basic and eligible Supplementary American Express Aeroplan Reserve Card members can receive 15% discount off the cost of parking (including taxes) which will be provided as a credit to your Basic American Express Aeroplan Reserve Card statement. The American Express Aeroplan Reserve No Fee Supplementary Cards are not eligible for this benefit. The parking lot is subject to availability. Discount available at Express Park in Terminal 1 and Daily Park in Terminals 1 & 3. 15% Discount cannot be used when reserving parking on Greater Toronto Airport Authority’s (GTAA) Parking Reservation system or in conjunction with any other offers or discounts offered by GTAA. For more information on parking lots visit torontopearson.com.

4 Toronto Pearson Discounted Car Care – Car Care services must be charged to your Basic and eligible Supplementary American Express Aeroplan Reserve Card. 15% discount off cost of Car Care services (including taxes) will be provided as a statement credit. The American Express Aeroplan No Fee Reserve Supplementary Cards are not eligible for this benefit. Only Canadian American Express Cards are eligible for the Car Care services. Subject to availability. Access to the Car Care services is available in Terminal 1 on level 5 of the Daily Park garage. For more information on parking lots visit torontopearson.com.

5 American Express® Aeroplan®* Reserve Cardmembers are eligible to receive up to $100 CAD in statement credits every four (4) years for application or renewal fees for the NEXUS program when charged to an eligible Card. Cardmembers will receive statement credits for their total spend on NEXUS fees rounded down to the nearest dollar, up to a maximum of $100 CAD in cumulative statement credits, per account per four (4) year period, regardless of whether the NEXUS fees are charged on the Basic or Supplementary Card. American Express will not provide additional statement credits once the maximum of $100 CAD in cumulative statement credits have been issued for subsequent NEXUS application or renewal fees charged to the same eligible Card within the same four (4) year period even if the original application is rejected. For existing Cardmembers as of September 1, 2021, the first four (4) year period runs from September 1, 2021 until August 31, 2025. For new Cardmembers after September 1, 2021, the first four (4) year period runs from the initial Card anniversary date until the day before the fourth (4th) Card anniversary date. In either case, each subsequent four (4) year period follows the period that immediately preceded it. American Express has no control over the application and/or approval process for the NEXUS program and does not have access to any information provided to the government by the Cardmember or by the government to the Cardmember. American Express has no liability regarding the NEXUS program. The NEXUS program is run by CBSA and the U.S. Customs and Border Protection independently (without administration by American Express). For additional information on the NEXUS program, please visit www.cbsa-asfc.gc.ca/prog/nexus/term-eng.html. The NEXUS program is subject to change, and American Express has no control over those changes.Please allow up to 8 weeks after the qualifying NEXUS transaction is charged to the eligible Card account for the statement credit to be posted to the Card account. American Express relies on accurate transaction data to identify eligible NEXUS purchases. If you do not see a credit for a qualifying purchase on your eligible Card after 6-8 weeks, simply call the number on the back of your Card. Cardmembers are responsible for payment of all application charges until the statement credit posts to the Card account. To be eligible for this benefit, Card account(s) must be active and not in default at the time of statement credit fulfillment.

◊ Official mark and/or trademark of Her Majesty the Queen in Right of Canada, used under license.

6 Priority PassTM – These Terms and Conditions govern Basic American Express Aeroplan Reserve Card participation in and use of the Priority Pass program. Priority Pass is an independent airport lounge access program. All lounge visits are subject to a usage fee at the prevailing rate, which is subject to change without prior notice. This fee applies to the Cardmember and his/her guests. Some lounges do not admit guests. By enroling in Priority Pass, you agree that you will be responsible for all visit costs and that your American Express® Aeroplan Reserve Card will be automatically charged after you have signed for the visit and it has been reported to Priority Pass by the participating lounge. Additionally, American Express will verify your Card account number and provide updated Card account information to Priority Pass. Priority Pass will use this information to fulfill on the Priority Pass program. Once your enrolment has been processed, Priority Pass will send you a welcome package, Priority Pass card and a list of participating lounges. For details on how Priority Pass uses your personal information, please refer to their privacy policy at prioritypass.com. Once enroled, American Express Aeroplan Reserve Cardmembers whose Card account is not cancelled may access participating Priority Pass lounges by presenting their Priority Pass card and airline boarding pass for same-day travel. In some lounges, Priority Pass member must be 21 years of age to enter without a parent or guardian. Priority Pass members must adhere to all house rules of participating lounges. Amenities may vary among airport lounge locations. Conference rooms, where available, may be reserved for a nominal fee. Priority Pass lounge partners and locations are subject to change. All Priority Pass members must adhere to the Priority Pass Conditions of Use, which will be sent to you with your membership package and can be viewed at www.prioritypass.com. Upon receipt of your enrolment information, Priority Pass will send your Priority Pass card and membership package which you should receive within 10–14 business days. If you have not received the Priority Pass card after 14 business days, please contact American Express using the number on the back of your American Express Aeroplan Reserve Card. Please note, Supplementary Aeroplan Reserve and Aeroplan Reserve No Fee Cardmembers are not eligible for membership. Priority Pass non-lounge airport experiences such as airport dining credits are only offered in a few select locations. Select locations are subject to change. For a complete listing of Priority Pass lounge and non-lounge airport experience locations, login to your account at www.prioritypass.com.

7 Purchase must be charged in full to an American Express Card. Subject to availability and to event and ticketing terms, restrictions, verification procedures and fees. Tickets and packages may not be transferable and should not be resold. No refunds and no exchanges subject to merchant’s obligations under applicable law.

8 Eligible cards will vary by offer and are subject to change. Select Canadian American Express Cards issued by Amex Bank of Canada and cards issued by a licensed third party issuer (as applicable) are eligible cards for the offer. The following cards are not eligible: American Express Corporate Cards, American Express® Gift Cards and Prepaid Cards. Subject to offer terms and conditions, and full program terms.

9 Underwritten by Royal & Sun Alliance Insurance Company of Canada. You may contact the insurer at 1-888-877-1710 in Canada and the U.S. or visit www.rsagroup.ca.

10 Underwritten by Royal & Sun Alliance Insurance Company of Canada. This coverage can only apply when you are authorized and permitted by law to operate the rental car. You may contact the insurer at 1-888-877-1710 in Canada and the U.S. or visit www.rsagroup.ca.

11 Underwritten by Chubb Life Insurance Company of Canada (“Chubb Life”). You may contact the insurer at 1-877-777-1544 in Canada or visit www.chubb.com/ca.

12 Underwritten by Royal & Sun Alliance Insurance Company of Canada. Applies to eligible items fully charged to your Card worldwide, provided the manufacturer’s warranty is valid in Canada and the U.S. and does not exceed five years. You may contact the insurer at 1-888-877-1710 in Canada and the U.S. or visit www.rsagroup.ca.

† : All insurance coverage is subject to the terms and conditions of their respective master policies. Certain limitations, exclusions and restrictions apply. Please read your Certificates of Insurance carefully.

®, : Used by Amex Bank of Canada under license from American Express.

Make the journey a destination with these

Air Canada ® * travel benefits

Our partnership with Aeroplan allows you to benefit from some of the most exceptional Air Canada

travel and airport benefits worldwide.

AIRPORT BENEFITS

Maple Leaf Lounge™ Access

Enjoy access to Maple Leaf Lounges TM in North America and the Air Canada Café TM for you and a guest 1‡ , with a same day ticket on a departing Air Canada or Star Alliance flight.

Priority Airport Services

Get access to Priority Airport Check-In, Priority Boarding and Priority Baggage Handling for you and up to 8 companions travelling on the same reservation for a trip that originates on an Air Canada flight. 2‡

Priority Airport Standby

Receive priority on the standby list when you and up to eight companions travelling on the same reservation are on standby at the airport for an Air Canada flight. Should a seat become available, you will be assigned it before members who have the same status but don’t hold an American Express Aeroplan Reserve Card. 3‡

Priority Airport Upgrades

If you’re a Cardmember with Aeroplan Elite TM Status, you and up to eight companions travelling on the same reservation get higher priority when you’re on standby for an upgrade on Air Canada flights. Should a seat become available, you will be assigned to it before Aeroplan members who have the same status but don’t hold an American Express Aeroplan Reserve Card. 3‡

AEROPLAN ELITE STATUS BENEFITS

Status Qualification Boost

As the Basic Cardmember, you will earn 1,000 Status Qualifying Miles and 1 Status Qualifying Segment for every $5,000 in eligible net purchases charged to your Card. 4‡

Rollover Status Qualifying Miles

Basic Cardmembers who hold Aeroplan Elite TM* Status can roll over up to 200,000 Status Qualifying Miles (SQM) to help qualify for Aeroplan status the following year. 5‡

Rollover eUpgrade Credits

Basic Cardmembers who hold Aeroplan Elite TM Status and requalify the following year can roll over up to 50 unused eUpgrade credits over to be used during the following status year. 6‡

ADDITIONAL BENEFITS

Annual Worldwide Companion Pass

Receive one Annual Worldwide Companion Pass when you spend $25,000 in net purchases prior to your Card anniversary date; your Pass entitles you to buy an accompanying Air Canada economy class ticket for a companion at a fixed base fare from $99 to a maximum of $599 CAD (plus taxes, fees, charges, and surcharges). 7‡

| Region(s) | Price (Base Fare) *Plus taxes, fees, charges and surcharges |

| Canada and Continental US (excluding Hawaii) | $99 |

| Hawaii, Mexico, Central America, and the Caribbean | $299 |

| South America, Europe, Middle East, and Africa | $499 |

| Asia (including India), Australia, and New Zealand | $599 |

Preferred Pricing

As a Basic Cardmember, you can often book flight reward tickets with Air Canada for even fewer points. 8‡

Free First Checked Bag

You and up to eight companions travelling on the same reservation will enjoy your first checked bag free (up to 23kg/50lb) when your travel originates on an Air Canada flight. 9‡

Terms and Conditions

‡ Please ensure that you provide your personal Aeroplan number to be linked to your card account as linking a different loyalty number may impact the airline benefit fulfillment.

The Aeroplan number of the person accessing the benefit must be included in the qualifying reservation, and the name on the airline reservation must be identical to the name on the Aeroplan account of the traveler. For eligible Supplementary Cardmember(s) ability to access available benefits, their Aeroplan number must be linked to a valid credit card account as verified by the bank. Linking can be done by visiting www.aircanada.com/linkmycard. Please allow up to 72 hours after the credit card is approved, or the Aeroplan number of the eligible Supplementary Cardmember is linked to the Additional Supplementary card, for these benefits to be activated. Aeroplan member accounts of the Basic Cardmember and eligible Supplementary Cardmember(s) must be in good standing at time of flight for airline benefits to apply. Airline benefits will no longer be available upon account closure, regardless of reason for closure, or if the card product is changed. Aeroplan membership and benefits are subject to the Aeroplan Program Terms & Conditions and any applicable Air Canada terms and conditions relating to a benefit, as determined by Air Canada in its sole discretion and as may be changed from time to time.

1 A Basic Cardmember and eligible Supplementary Cardmember(s) are each entitled to complimentary access to Air Canada Café and any Maple Leaf Lounge located only in Canada and the United States, including International Maple Leaf Lounges in Canada and the United States when travelling on an international itinerary. Access excludes Maple Leaf Lounges outside of Canada and the United States, Air Canada Signature Suites, and lounges operated by third parties, such as Star Alliance member airlines. Basic and eligible Supplementary Cardmember(s) are each entitled to offer one (1) guest complimentary access to the same eligible Maple Leaf Lounge and Air Canada Café. Any guest entering a Maple Leaf Lounge and Air Canada Café must be accompanied by a Basic or eligible Supplementary Cardmember. Additional guest(s) may enter the Maple Leaf Lounge upon paying an applicable fee. For greater certainty, a Basic Cardmember or eligible Supplementary Cardmember who holds Aeroplan Elite Status, may additionally take advantage of the lounge access benefits available to them as part of the Aeroplan Elite Status program. For more information on Aeroplan Elite TM Status, please visit aircanada.com/elitebenefits. Access to Maple Leaf Lounges and Air Canada Café is available in conjunction with a same-day ticket when departing on a flight marketed or operated by Air Canada, Air Canada Rouge, under the Air Canada Express brand, or any Star Alliance member airline. Anyone under the age of majority entering a Maple Leaf Lounge must be accompanied by an adult with access to the lounge. Age of majority is determined by the jurisdiction in which the Maple Leaf Lounge is located. Benefit may only be used as described, and otherwise cannot be transferred. Access is subject to space availability. See www.aircanada.com/lounges-termsandconditions for applicable Maple Leaf Lounges Terms and Conditions.

2 A Basic Cardmember or Supplementary Cardmember, and up to eight (8) other passengers traveling on the same reservation (up to a maximum of nine (9) travellers), are each entitled to Priority Check-in (where available), Zone 2 Priority Boarding and Priority Baggage Handling. Benefits only apply when checking in with Air Canada, for a flight operated by Air Canada, Air Canada Rouge or under the Air Canada Express brand. Benefit is not available if check-in is with another airline. To access this benefit, the Basic Cardmember or Supplementary Cardmember may be required to show their qualifying card to the Air Canada agent.

3 A Basic Cardmember or Supplementary Cardmember, and up to eight (8) other passengers traveling on the same reservation (up to a maximum of nine (9) travellers), are each entitled to Priority Airport Standby, and a higher priority for upgrade requests to a premium cabin. Priority airport standby and upgrade clearance are available on day of travel when travelling on a fare that allows for airport standby or upgrades, and upon satisfying applicable condition(s), such as payment of fees or use of upgrade instrument(s), such as eUpgrade credits. Benefit only applies for flights operated by Air Canada, Air Canada Rouge, or under the Air Canada Express brand. Priority on standby and upgrade lists is determined by several factors, including, but not limited to, holding Aeroplan Elite TM Status, an eligible Aeroplan credit card, and other rules as determined by Air Canada in its sole discretion and as may be changed by Air Canada from time to time. See www.aircanada.com/elite-termsandconditions for applicable Aeroplan Elite Status and eUpgrade conditions.

4 For every $5,000 in eligible purchases (less any returns, credits and adjustments) charged to the card and posted to the card account, Basic Cardmembers will earn 1,000 Status Qualifying Miles (SQM) and 1 Status Qualifying Segment (SQS) which will be deposited in their Aeroplan member account and appear on the next card account billing statement. Please allow at least three (3) days after being earned for the SQM and SQS to be added to your Aeroplan account. SQM and SQS are not redeemable towards Aeroplan rewards and only count toward Aeroplan Elite Status qualification. SQM do not count towards Million Mile Status. Supplementary Cardmember(s) are not eligible to receive SQM or SQS through this benefit; however, all eligible spend by Supplementary Cardmembers will count towards the Basic Cardmember’s spend. Basic Cardmembers may earn unlimited bonus SQM and SQS during an Aeroplan Elite Status qualification period. In the case of returns, credits or adjustments that reduce the amount of net purchases below a previously achieved threshold for which SQM and SQS was not previously awarded, you may not earn the SQM and SQS, but if you were awarded SQM and SQS, the amount deducted could result in you having negative net purchases and you will have to make purchases if you wanted to bring your net purchases to zero before earning towards your next SQM and SQS. All Aeroplan Elite Status conditions apply and can be reviewed at www.aircanada.com/elite-termsandconditions.

5 Basic Cardmembers who also hold Aeroplan Elite Status will be able to roll over up to a maximum of 200,000 Status Qualifying Miles (SQM) from the prior qualification year to the next qualification year. This benefit applies when the member qualified for Aeroplan Elite Status by earning the required SQM or Status Qualifying Segments (SQS), as well as the required Status Qualifying Dollars (SQD), in the prior qualification year. If the member has been granted complimentary status, as determined by Air Canada, that is higher than the status they would have earned via their Status Qualifying balances, the rollover amount will be based on the status they would have earned otherwise (if any), and not the granted status. SQM rolled over from the previous qualifying year will apply towards status qualification for the following qualifying year. Rollover SQM will be deposited directly into the member’s Aeroplan account no later than March 30 of any given year, provided the member earned at least Aeroplan 25K Status based on their Status Qualifying balances from the prior qualifying year. Rollover does not apply to SQS or SQD. Benefit is only available to Basic Cardmembers and does not apply to Supplementary Cardmembers. In the event the card is changed to a different product or the account is closed, regardless of reason for closure, any SQM rolled over as a result of this benefit will be removed from the Aeroplan account, and any status earned as a result of these rolled over SQM may also be rescinded. SQM do not count towards Million Mile Status and are not redeemable towards Aeroplan rewards. Where a Basic Cardmember is eligible to roll over SQM under another Aeroplan credit card, the total cumulative roll over of all SQM towards Aeroplan Elite Status cannot exceed the maximum of 200,000 SQM. All Aeroplan Elite Status conditions apply and can be reviewed at www.aircanada.com/elite.

6 Basic Cardmembers who also hold Aeroplan Elite Status will be able to roll over up to a maximum of 50 eUpgrade credits received in the prior status year to the next status year. eUpgrade credits issued on a promotional basis, as well as those already rolled over from a previous benefit year, are not eligible for this benefit. Rollover eUpgrade credits will be deposited directly into the member’s Aeroplan account no later than March 30 of any given year, provided the member holds Aeroplan Elite Status at that time, and held Aeroplan Elite Status in the previous benefit year. If the card is changed to a different product or the account is closed, regardless of reason for closure, any unused, rolled over eUpgrade credits will be forfeited and removed from the member’s eUpgrade account. Benefit is only available to Basic Cardmembers and does not apply to Supplementary Cardmembers. Where a Basic Cardmember is eligible to roll over eUpgrade credits under another Aeroplan credit card, the total cumulative roll over of all eUpgrade credits cannot exceed the maximum of 50 eUpgrade credits. All eUpgrade conditions apply and can be reviewed at www.aircanada.com/eupgrade-termsandconditions.

7 Basic Cardmembers will receive one (1) Annual Companion Pass after spending more than $25,000 on net purchases (less any returns, credits, and adjustments) posted to the Basic Cardmember’s card account in the 12 months prior to their Card anniversary date. The pass will be deposited into the Aeroplan account 8-10 weeks after the Card anniversary date.

On each Card anniversary date, the calculation of the annual net purchases resets to zero and Basic Cardmembers must qualify again in the new annual period. Purchases transacted or posted on the Card anniversary date will be included in the calculation of net purchases for the next annual period and not the previous annual period.

The pass entitles a companion to accompany the Basic Cardmember upon the purchase of a fixed base fare (plus taxes, fees, charges and surcharges), when the Basic Cardmember books a published economy fare on a flight marketed and operated by Air Canada, Air Canada Rouge or under the Air Canada Express brand.

Valid against the purchase of one round-trip fixed based fare (plus taxes, fees, charges and surcharges) for a companion when travelling on the same itinerary and booked at the same time as the Basic Cardmember. Passes are valid for 12 months from the date issued. The pass is valid towards a new booking only, and not valid on existing reservations. Bookings must be made directly with Air Canada, via aircanada.com, the Air Canada Mobile App, or through the Air Canada call center (“Air Canada Reservations”).

Maximum of one companion pass may be used per booking. If one-way travel is booked, the full base fare will be charged, the pass will be deemed fully used and the return portion of travel will be forfeited.

Total pricing varies based on itinerary booked. Basic Cardmembers may use the pass only once on their choice of travel (i) within Canada and continental US (excluding Hawaii) for $99 CAD base fare (ii) to/from Hawaii, Mexico, Central America, and the Caribbean for $299 CAD base fare, (iii) to/from South America, Europe, Middle East, and Africa for $499 CAD base fare, and (iv) to/from Asia, Australia, and New Zealand for $599 CAD base fare.

In addition to the purchase of a fixed base fare, the companion will be responsible to pay all applicable taxes, fees, charges and surcharges that apply above the companion’s base fare. All travel must originate or terminate in Canada or the United States. Valid for travel at any time with no blackout periods. Also valid against the purchase of fares on sale.

The companion will be booked into the same fare brand as the Basic Cardmember and will receive all applicable benefits and services associated with that fare brand. The pass may not be used against the purchase of premium cabin fares, or in conjunction with Aeroplan flight rewards, Flight Pass, group travel bookings, Air Canada Vacations bookings, or any other discounts or promotion codes.

The pass must be redeemed at the time of purchase, and if multiple companion passes are available in association with the same Aeroplan number, the pass that would expire first will be used. Booking must be made before the pass expiry date, but travel may occur after the pass expiry date subject to flight schedule availability at the time of booking.

Pass may only be used as described, cannot be transferred and has no monetary or exchange value. Changes or cancellations are allowed according to the fare rules of the fare purchased.

Changes and cancellations must be made at the same time for both the Basic Cardmember and the companion, and failure to do so may result in the companion pass being forfeited. If during a change or cancellation the pass is reinstated in the Basic Cardmember’s Aeroplan account, the original expiry date will take effect and the pass may then be considered expired. In the event of a change or cancellation, travelers are required to pay all applicable fees based on the fare type purchased for each ticket, plus the difference in fare, if applicable, and all taxes, fees, charges and surcharges that apply above the base fare. The Basic Cardmember’s account must be and remain active (not cancelled) and in good standing in order to receive and retain the reward.

Companions who are members of Aeroplan or other partner frequent flyer programs are eligible to accumulate points and/or miles for the ticket issued in exchange for the companion pass according to conditions of the fare brand purchased.

Aeroplan Elite Status benefits and upgrades are applicable if the traveler holds appropriate status and the fare purchased allows.

Air Canada reserves the right to apply additional fees for bookings made via Air Canada Reservations. Unused passes will automatically be cancelled on the date the card account is cancelled, regardless of reason for cancellation, or if the card account is changed to a different product.

Air transportation services on Air Canada are subject to Air Canada’s General Conditions of Carriage & Tariffs (www.aircanada.com/conditionsofcarriage) at the time of booking.

8 From time to time, eligible Basic Aeroplan Cardmembers can get access to preferred pricing, which means they can book flight rewards for even fewer points. The number of points required to book a flight reward is determined by several factors, including, but not limited to, holding an eligible Aeroplan credit card and a member logging into their Aeroplan account, along with other rules as determined by Aeroplan in its sole discretion.

9 A Basic Cardmember or eligible Supplementary Cardmember, and up to eight (8) other passengers traveling on the same reservation (up to a maximum of 9 travellers), are each entitled to a free first checked bag up to 23kg/50lb. Benefit only applies when checking in with Air Canada, for a flight operated by Air Canada, Air Canada Rouge or under the Air Canada Express brand. Benefit is not available if check-in is with another airline. If the first checked bag is already complimentary (for example, as a result of Aeroplan Elite Status or fare purchased), there is no additional checked bag benefit that will be provided. Free first checked bag benefit may not be applied retroactively, and no refunds will be issued. Service charges for additional/oversized/overweight baggage may apply. For more information on baggage restrictions, please visit www.aircanada.com/baggage.

® : Used by Amex Bank of Canada under license from American Express.

Seniors Travel Insurance – Get a quick quote

Great news! 1Cover policies now include medical cover for COVID-19.

Before you buy, please read our travel alerts.

reviews on

why do you Need seniors travel insurance?

Travel has become complex since COVID-19 became a worldwide pandemic and travel insurance is more important than ever.

We understand that many Australian travellers are concerned about catching the coronavirus while overseas and have made product changes to put your mind at ease. You can relax and enjoy your much-needed getaway knowing that 1Cover travel insurance covers you for overseas medical expenses if you catch COVID-19 on your holiday.

While we all hope the unexpected doesn’t happen, it is best to be prepared. 1Cover Travel insurance for seniors can give you peace of mind on your upcoming trip by covering overseas medical expenses, luggage theft, cancellation fees and much more.

Whether you’re looking for travel insurance for over 50s, over 60s, or over 70s, our travel insurance policies offer coverage for Australian seniors. Duration limits, age limits and other limits may apply upon cover extension.

Planning your next trip is exciting regardless of your age. We’ve prepared a comprehensive guide on where to go, when to go and what risks to avoid. Check out our seniors holiday guide to start planning and dreaming about your next trip!

Benefits of Seniors Travel Insurance

See below for just a few of the benefits seniors travel insurance provides. For a full list of benefits, see our coverage page.

Unlimited Medical

We offer unlimited medical cover for all travellers under 80, so you can travel with peace of mind. See the PDS for details.

Pre-Existing Medical Conditions

We have an easy medical screening process that allows you to apply to cover your pre-existing medical conditions.

Unlimited Cancellation

Plans change before you travel. That’s why we offer cover for cancellation fees and lost deposits.

Grandkids Covered For No Extra

- Travelling with your grandkids? They’re covered for no extra cost. We only charge you for each adult on your policy.

Travel Insurance Award Winners 2022

Table of Benefits – Seniors Travel Insurance

1Cover offers a Medical Only travel insurance policy and a Comprehensive travel insurance policy for Australian seniors looking to travel overseas. Compare the benefits below, or see the full details in the Policy Wording. Refer to the PDS for full details or get a quote now.

Source https://www.americanexpress.com/ca/en/membership-benefits/aeroplan-reserve-card/

Source https://www.1cover.com.au/seniors-travel-insurance/

Source